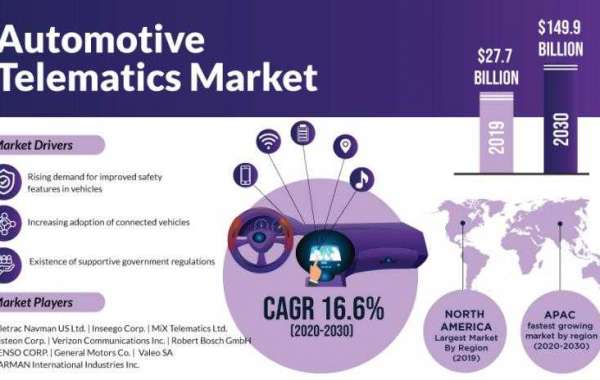

Telematics solutions are being incorporated in vehicles to provide a safer driving option. The installation of these devices aids in reducing the number of road accidents, which kill over 1.3 million people each year, as per the World Health Organization (WHO). Thus, the escalating demand for improved safety features in automobiles and efficient road traffic will accelerate the automotive telematics market at a robust CAGR of 16.6% during 2020–2030. According to P&S Intelligence, the market value will increase from $27.7 billion in 2019 to $149.9 billion in 2030.

Additionally, the market growth will be driven by the incorporation of 5G network technologies in the telematics instruments, as 5G allows for higher radio frequencies than 4G technologies. Telematics solutions intensify the complexity of vehicle technologies, which, in turn, creates the need for improved network connectivity to simplify their functioning. Verizon Communications Inc. introduced the 5G network in the U.S. in December 2019, thus becoming one of the first companies to launch this cellular network technology.

Moreover, the spurring demand for connected cars will fuel the adoption of telematics devices in the automobile industry. These cars offer benefits such as vehicle-to-infrastructure (V2I) and vehicle-to-vehicle (V2V) connectivity, which are two of the key applications of telematics solutions. Additionally, connected cars offer smartphone connectivity within the vehicle, traffic and collision warnings, real-time traffic monitoring, roadside assistance, and automobile diagnostics with the help of telematics solutions. The installation of these devices has additionally increased significantly due to the stringent government regulations regarding vehicle and road safety.

The service segment of the automotive telematics market is categorized into safety and security, infotainment and navigation, and remote diagnostics. During the historical period (2014–2019), the safety and security category dominated the market, as telematics solutions offer road assistance and allow drivers to remotely lock and unlock the vehicle. Moreover, telematics offer the fleet management service, which includes functions such as vehicle maintenance alerts, vehicle telematics, and vehicle financing. Furthermore, the remote diagnostics category will display the fastest growth during the forecast period, as the service offers efficient on-time solutions to automobile faults, by analyzing the vehicle health beforehand.

Geographically, North America adopted the highest number of automotive telematics devices in 2019, due to the enactment of numerous government policies on road safety. For example, the Federal Motor Carrier Safety Administration (FMCSA) has mandated the incorporation of electronic logging devices (ELD) in all commercial vehicles in the U.S. Such favorable policy frameworks, along with the rising investments by private and government organizations, are widening the scope for innovation in telematics technologies. Moreover, the escalating demand for long-haul trucks in the U.S. has propelled the installation of telematics devices.

The Latin America, Middle East, and Africa (LAMEA) automotive telematics market is projected to register the fastest growth in the forecast period. This would be because the market in the regional developing countries, such as Mexico and Brazil, is still at an infant stage and, thus, holds a huge growth potential. Moreover, developments in the infrastructure and the favorable government policies will support the market growth in the future. Additionally, Asia-Pacific (APAC) will emerge as the second-largest market due to the surging demand for connectivity technologies, fleet telematics, and safety features in vehicles.

Thus, the magnifying demand for connected cars and increasing government support to enhance road safety will fuel the adoption of telematics solutions in the automobile sector.