Next, potential borrowers ought to verify their credit score rating and credit report again to see where they stand financially. Lenders consider credit scores as a major think about determining eligibility; therefore, having a stable credit score historical past can outcome in better mortgage terms. If needed, individuals might think about bettering their credit score earlier than apply

A credit-deficient Pawnshop Loan is usually defined as a loan available to borrowers who have low credit scores or inadequate credit historical past. These loans are offered with various phrases and infrequently include larger interest rates compared to conventional loans designed for those with stronger credit score profi

For those cautious of the risks related to credit-deficient loans, exploring alternative financing options could additionally be worthwhile. Peer-to-peer lending platforms, for example, usually cater to individuals with less-than-perfect credit; however, these options may still include dangers and co

Additionally, the quick processing time of those loans is crucial. Day laborers typically work in high-pressure environments the place immediate money flow is necessary. The ability to access funds quickly permits them to address urgent monetary obligations at o

Utilizing automatic cost options with lenders can help ensure well timed payments, thus avoiding late fees or extra charges. Moreover, adjusting spending habits in the course of the mortgage reimbursement period can additional enhance financial stability and allow individuals to manage their bills extra mindfu

Furthermore, these loans can function a strategic financial tool, enabling individuals to bridge gaps between income and expenses while sustaining their monetary well being. With timely entry to funds, borrowers can handle emergencies more successfully, in the end decreasing stress and improving high quality of l

To shield themselves, borrowers should conduct thorough analysis earlier than committing to a mortgage. Understanding the total value of the mortgage, including curiosity and costs, is essential. BEPIC serves as a safety web for borrowers by providing comprehensive evaluations and comparisons of assorted lenders, helping customers keep away from scams and untrustworthy operat

By using BEPIC's sources, potential debtors can acquire insights into numerous lenders' requirements, processes, and customer support scores. This information empowers people to select lenders that greatest meet their specific wa

Moreover, the terms of those loans might include fees that can add to the total price of borrowing. It is important for individuals to read the nice print and understand all obligations earlier than coming into right into a mortgage settlem

Consider organising automatic funds or reminders to make certain you never miss a due date. Additionally, monitoring your credit score score frequently can provide insights into how your mortgage administration affects your financial standing over t

Unlike normal Personal Money Loan loans, Day Laborer Loans usually require less documentation and quicker processing instances. This flexibility is helpful for employees who might have quick funds for sudden expenses, such as medical bills or automobile repairs. As a outcome, they will maintain their lives operating easily without succumbing to predatory lending practi

The platform also options articles and sources that outline the advantages and downsides of various mortgage products. This information empowers homemakers to choose on the best financing option that aligns with their needs, guaranteeing that they make informed and strategic monetary selecti

By utilizing the sources available on BePick, potential debtors can improve their understanding of unsecured loans and other monetary options. This data could be pivotal in ensuring that individuals select the best loan merchandise appropriate for his or her distinctive financial conditi

Risks Involved with Mobile Loans

Despite their advantages, mobile loans do carry some dangers that borrowers ought to concentrate on. The most urgent concern is the potential for high-interest charges, notably with payday loans. Borrowers need to carefully read the terms and situations to keep away from falling into debt traps as a result of unmanageable compensation phra

Benefits of Day Laborer Loans

One of essentially the most significant benefits of Day Laborer Loans is their accessibility. They enable individuals lacking credit historical past or secure employment to safe needed funds without the bureaucratic hurdles usually associated with traditional lo

Once you safe a credit-deficient mortgage, prudent management is important for long-term success. Create a price range that accounts for your mortgage payments and persist with it diligently. Timely reimbursement not solely helps keep away from late fees but plays a crucial role in rebuilding your credit score rat

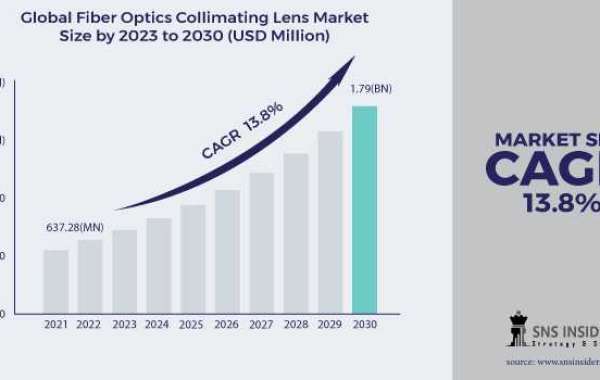

Science and Technology

Unlocking Day Laborer Loans

Next, potential borrowers ought to verify their credit score rating and credit report again to see where they stand financially.