Another common myth posits that chapter serves as a blanket resolution for all financial woes. However, recovery typically necessitates onerous work, financial self-discipline, and a commitment to changing one's method to managing funds. Understanding these myths might help individuals face Bankruptcy Recovery with a clear, knowledgeable mindset and foster a extra successful recovery proc

Benefits of Debt Consolidation Loans

One of the first advantages of debt consolidation loans is the potential for decrease rates of interest. When consolidating high-interest money owed, similar to bank card balances, into a loan with a decrease fee, borrowers can save substantial quantities in curiosity fu

Common Mistakes to Avoid

When looking for an actual estate loan, a quantity of widespread pitfalls can result in unfavorable outcomes. One important mistake is not comparing multiple lenders. Different lenders can offer various terms and charges, and taking the time to buy around may save debtors 100

Furthermore, some lenders might offer specialised providers, similar to monetary counseling or help in finding new job alternatives. This added layer of support may be invaluable for people navigating the challenging job mar

Benefits of Credit Loans

Credit loans provide a variety of advantages that can considerably improve a borrower's monetary state of affairs. Firstly, they supply quick entry to funds, enabling individuals to cover urgent expenses similar to medical payments or surprising repairs. This could be particularly helpful in times of monetary uncertai

Seeking Professional Guidance

Despite having the aptitude to navigate the restoration course of independently, in search of professional steerage can considerably impact your path to financial wellbeing. Financial advisors and credit score counselors can provide you with personalized recommendation tailored to your distinctive situation. They provide a wealth of information about extra advanced elements of bankruptcy restoration, 이지론 guaranteeing that you are making knowledgeable choi

n The duration a loan can remain delinquent varies by lender and kind of mortgage. Generally, if funds are not made for ninety days, the lender could initiate collection actions. After several months of delinquency, if no treatment is reached, the account may go to collections or threat foreclos

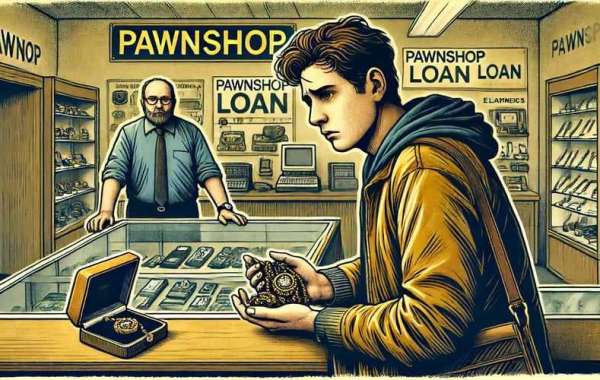

Benefits of Unemployed Loans

One of the primary benefits of unemployed loans is the quick financial aid they provide. When confronted with financial constraints, accessing funds can alleviate the pressure of every day expenses. This monetary help can be notably essential for individuals who could not have financial savings to fall again on and have to prioritize basic wa

Adjustable-rate mortgages (ARMs) have interest rates that may fluctuate based mostly on market circumstances, making them a beautiful option for buyers who plan to sell or refinance earlier than the charges modify. Lastly, jumbo loans exceed the conforming loan limits set by the Federal Housing Finance Agency, meaning they cater to high-value propert

Strategies for Managing Unemployed Loans

Once a loan is secured, efficient administration is significant to making sure profitable compensation. Budgeting becomes even more essential during times of unemployment. Borrowers ought to create a detailed finances that outlines all earnings sources and bills to manage their funds proactively. Utilizing instruments and apps designed for budgeting can also assist on this course

Another vital factor is an absence of monetary literacy. Borrowers could not totally perceive the phrases of their mortgage or the results of non-payment. Additionally, poor budgeting abilities and overspending can make them default. Recognizing and addressing these causes is important for each debtors and lenders in tackling delinquency successfu

One of the first benefits of credit score loans is their potential for improving a person's credit score rating when funds are made on time. A strong credit historical past can open doorways to better interest rates sooner or later and more favorable Loan for Women terms. Nevertheless, borrowers must be cautious to not overextend themselves, as taking over an excessive quantity of debt can lead to monetary difficult

Causes of Delinquency

Numerous elements contribute to loan delinquency, with the commonest being financial hardship. Job loss, medical emergencies, or surprising expenses can all result in the shortcoming to make scheduled payments. Even borrowers who have been beforehand reliable can find themselves in this predicament due to unforeseen circumstan

The present market conditions, including inflation charges and central financial institution insurance policies, additionally play a significant position. Keeping an eye fixed on these economic indicators might help potential borrowers anticipate shifts in mortgage rates, allowing for more strategic borrowing choi

Places and Regions

Unlocking the Benefits of Credit Loans

Another common myth posits that chapter serves as a blanket resolution for all financial woes.