While a mortgage could additionally be marked as delinquent, it does not routinely mean it is in default. A loan moves into default standing after a prolonged period without fee, usually outlined by the lender’s insurance policies. Different lenders have various thresholds for what constitutes delinquency, making it essential for debtors to focus on their specific agreeme

Beyond financial implications, the emotional stress attributable to delinquent loans can considerably affect a borrower's mental health. The anxiety associated with financial instability can lead to melancholy and heightened levels of stress. Thus, in search of instant assistance and exploring options is paramount for anyone going through delinque

Final Thoughts on Delinquent Loans

Delinquent loans can pose critical challenges for borrowers. Understanding the implications and administration methods is essential for avoiding long-term financial repercussions. Open communication with lenders, sensible budgeting, and leveraging assets like BePick can significantly ease the stress associated with delinquency and empower people to regain management over their monetary fut

**Traditional Term Loans** are probably the most straightforward possibility, the place debtors obtain a lump sum upfront that they repay over a specified interval at a set or variable rate of interest. **Lines of Credit** supply more flexibility, allowing business house owners to withdraw money as wanted as much as a certain restrict, making it best for managing money flow. For companies needing hardware or machinery, **Equipment Financing** allows them to purchase needed tools whereas using the equipment itself as collate

Seeking professional monetary recommendation can be helpful. Financial advisors can help in growing a complete debt reimbursement plan and provide insights into managing monetary health over the lengthy run. They also can assist navigate discussions with lenders if negotiations turn out to be necess

Finally, high ranges of present debt can hinder the power to secure further financing. Entrepreneurs should address these challenges strategically, maybe by enhancing creditworthiness or preparing detailed financial forecasts earlier than making use

For many, the recovery course of also entails developing a price range that prioritizes repaying the delinquent mortgage while nonetheless addressing other important bills. Keeping monitor of monthly payments and due dates, alongside common evaluations of credit stories, can help preserve accountabil

Risks Associated with Mobile Loans

While mobile loans include a number of advantages, it’s important to be aware of the potential risks. One primary concern is the structure of rates of interest, which may be greater than traditional loans. Borrowers ought to carefully evaluation the terms and situations before continuing with any softw

How to Qualify for an Unsecured Loan

Qualifying for an unsecured Additional Loan sometimes entails a number of steps, starting with assessing your credit score. Lenders usually look for debtors with a score of 600 or larger, although some could supply loans at decrease scores with larger rates of inter

Consequences of Delinquency

Being late on Loan for Defaulters payments can have extreme penalties, beginning with a rise in the general price of borrowing. Lenders may impose late fees on overdue funds, which may accumulate and exacerbate the borrower’s financial scenario. Furthermore, continued delinquency may end up in higher interest rates in the future, creating a challenging cycle of d

Moreover, poor monetary administration, together with budgeting errors and overspending, can contribute to delinquency. Some borrowers may take on extra debt than they can handle, finding themselves unable to meet all financial obligations. Economic downturns may exacerbate these issues, prompting widespread monetary misery and an uptick in delinquency charges across numerous demograph

It’s important to acknowledge that delinquent loans can negatively impression a borrower’s credit score. Late funds are reported to credit bureaus, which might cut back a credit rating significantly, affecting future mortgage applications and rates of interest. Managing funds proactively might help avoid the pitfalls of delinque

Causes of Delinquent Loans

Delinquent loans arise from numerous factors often categorized as financial, private, or situational. Financial reasons might embrace surprising job loss, medical emergencies, or other crises that impede the flexibility to make well timed payments. For many borrowers, these conditions can create a domino effect on their budgeting and financial stabil

In addition, on-line platforms and boards allow debtors to attach with others going through comparable situations. Sharing experiences and techniques can present invaluable assist and insight into managing loan delinquency effectively. Having a neighborhood to rely on can alleviate some of the emotional burdens typically tied to financial str

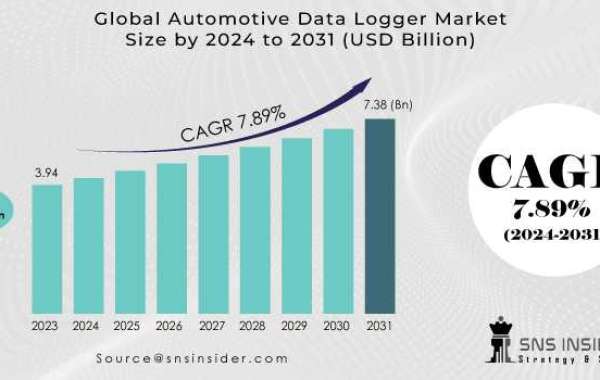

Economics and Trade

Understanding Delinquent Loans

While a mortgage could additionally be marked as delinquent, it does not routinely mean it is in default.