Loan Forgiveness Programs

For those in public service fields or certain professions, scholar mortgage forgiveness applications can alleviate monetary burdens considerably. Programs like the Public Service Loan Forgiveness (PSLF) program aim to inspire graduates to work in important sectors by offering loan forgiveness after a specified interval of qualifying fu

The Role of 베픽 in Women's Loans

베픽 serves as a pivotal resource in the realm of women’s loans, providing in depth information and critiques that information girls in making knowledgeable financial choices. The platform provides insights into numerous lending options available for women, highlighting their features, benefits, and person experien

Additionally, contemplate lenders that supply versatile loan terms. Some lenders might provide options for repayment extensions or could also be more accommodating in case of financial difficulties. Finding a lender that addresses your needs can significantly influence your borrowing expertise and overall satisfact

Moreover, borrowers experiencing financial hardship could explore deferment or forbearance options to temporarily pause their payments. These measures can present some aid, but they typically lead to accrued interest, which can increase the general loan stabil

What is a Delinquent Loan?

A delinquent Real Estate Loan happens when a borrower fails to make scheduled funds on a mortgage. The standing can differ relying on how late the payment is, sometimes categorized into 30, 60, or ninety days late. The longer a mortgage is delinquent, the extra significant the repercussions that borrowers face. For instance, loans which might be 30 days past due could incur late fees while impacting credit score scores. If the delinquency persists, it could possibly escalate to 90 days or extra, potentially leading to foreclosures in the case of mortgages or repossession in phrases of auto lo

The Benefits of Women's Loans

One of the significant advantages of women-focused loans is the accessibility they supply. Many lending institutions acknowledge the barriers women face and offer more lenient criteria for approval. This helps extra ladies achieve entry to funds which will have been in any other case out of att

Moreover, mortgage approval processes could be stringent, making it difficult for ladies, particularly those who are self-employed or operating small companies, to meet the required standards. Therefore, assist networks and assets are important in empowering women to deal with these challenges and safe their financial fut

Understanding the specifics of delinquency is crucial for each customers and monetary institutions. For lenders, the identification of delinquent accounts is essential to managing their risk and ensuring liquidity. Borrowers, on the opposite hand, should pay consideration to their obligations and the implications of failing to fulfill t

Yes, there are a number of grants out there specifically for women that can complement loans. These grants may be offered by authorities applications, nonprofits, or non-public organizations aimed toward supporting ladies in business or training. These funds don't require compensation, making them a wonderful method to enhance a financial portfolio alongside a l

Auto loans are a critical side of car ownership for so much of people. Understanding the intricacies of the auto loan process can prevent time, cash, and stress. This information will delve into numerous parts of auto loans, together with sorts, interest rates, and tips for securing the best offers. We may even introduce BePick, a priceless useful resource for anybody looking for detailed information and evaluations on auto lo

Interest Rates and Their Impact

Interest rates are a crucial element in any auto mortgage scenario. They can range significantly based on a number of components, including the borrower’s credit score rating, the mortgage term, and the type of automobile being purchased. A decrease credit score score typically leads to the next rate of interest, which will improve the general price of the mortg

Resources and Support for Women in Finance

To help overcome these challenges, varied organizations and resources can be found to support women in their financial endeavors. There are nonprofit organizations devoted to bettering women’s monetary literacy, providing workshops and academic supplies to boost their understanding of loans and financial managem

Drawbacks to Consider

Despite their benefits, every Same Day Loan loans include significant drawbacks that potential borrowers should contemplate. The most regarding side is the high-interest charges related to these loans. Financial consultants typically warn that failing to repay the mortgage on time can result in a cycle of debt that is difficult to esc

Additionally, speaking with lenders about expectations and challenges can help preserve a clear understanding of your obligations. If payment points come up, addressing them promptly can often lead to different preparations or deferments, rather than waiting till the delinquency becomes seri

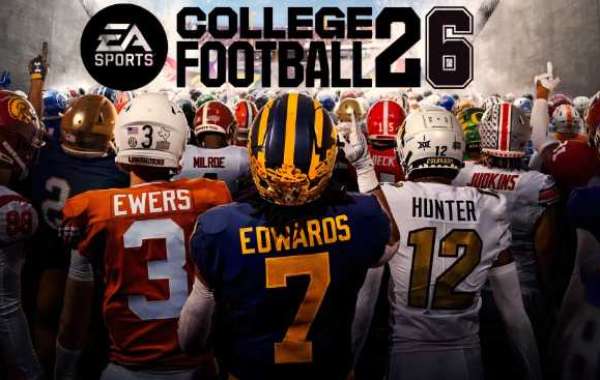

Entertainment

Understanding Delinquent Loans

Loan Forgiveness Programs

For those in public service fields or certain professions, scholar mortgage forgiveness applications can alleviate monetary burdens considerably.